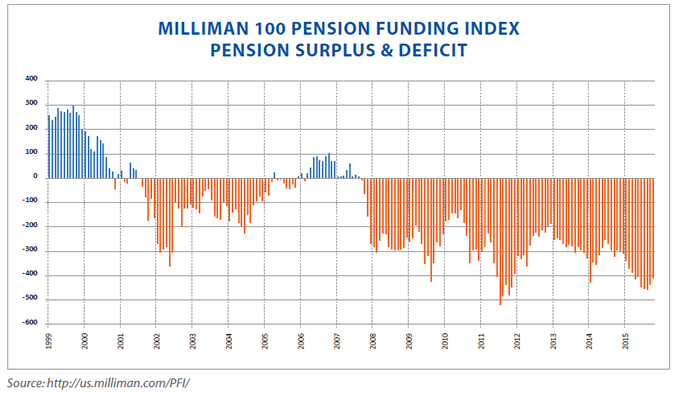

You are looking at Medicare, sovereign debt, pension funds, and on it goes, literally quadrillions of dollar value and they can’t even pay for that with the existing GDP. Current IOUs far exceed the ability to service that debt. Even with the highest stock market ever in the US, they still can’t pay for that. Governments need to find wealth from somewhere.

You are looking at Medicare, sovereign debt, pension funds, and on it goes, literally quadrillions of dollar value and they can’t even pay for that with the existing GDP. Current IOUs far exceed the ability to service that debt. Even with the highest stock market ever in the US, they still can’t pay for that. Governments need to find wealth from somewhere.

If a 10x return to $70,000 per BTC in the future clears part of the liabilities, why not let it run even further? If it pushes to $140K, people will then have money to spend and rekindle the economy.

Seven Reasons Bitcoin will Reach $70,000 — One Bitcoin Future

By David DuByne of Adapt 2030

As we stand in the current world economy, suffocating and on its last breath, we face three choices to resolve the global liquidity crisis:

- a debt jubilee

- a global war

- bitcoin (BTC) futures.

My choice is BTC futures.

This is not to say that bitcoin was created and released at a particular time for this exact end result, but for sure central banks are taking advantage of it to solve multiple problems.

The Cliff Notes version: letting BTC futures run up to $70,000 on the Chicago Mercantile Exchange (CME) will have these results.

- Global war prevented

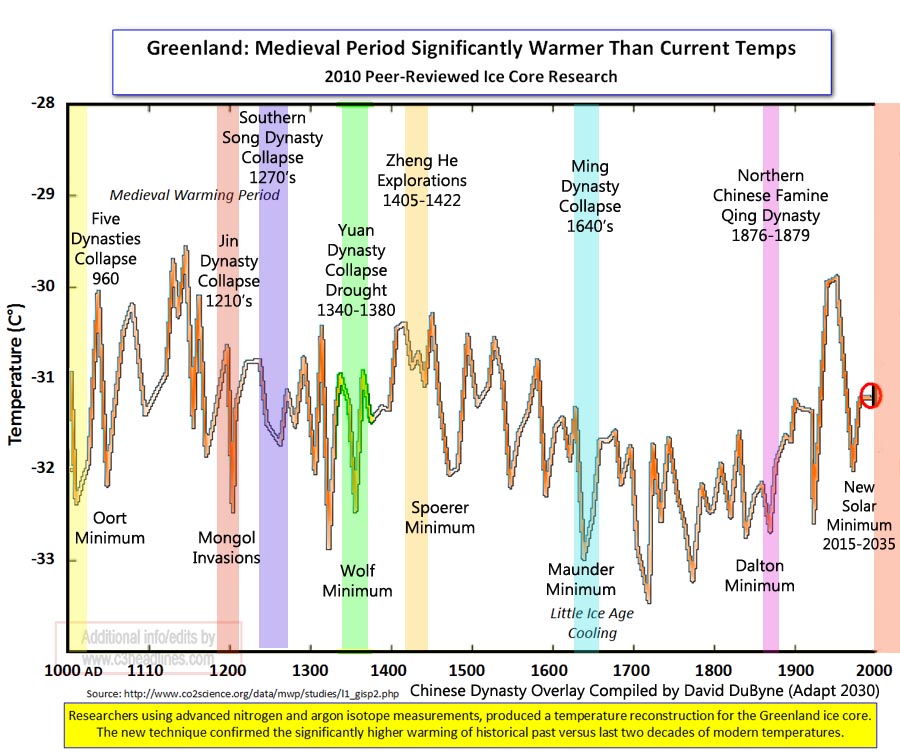

- Civil unrest mitigated, as food prices climb higher due to Grand Solar Minimum* losses in global agricultural output

- Refilled pension funds and underwater liabilities planet wide

- Backdoor way to institute universal income

- A way to restart the consumer spending economy

- A beginning to fixing poverty everywhere

- Anyone, anywhere can invest in bitcoin futures, so the wealth effect spreads everywhere

- As BTC skyrockets, everything else will follow, as in the stock market

We can start a global war. Or we can set the bottom price of BTC at $7000 and open it on the futures market, solving all of the liquidity and debt problems we now experience. It will take 10x the current $7000 mark to breakeven and backfill the current funding negatives at debt to GDP.

The US Federal Reserve, central banks and governments around the world have massive unfunded liabilities that will not be repaid even if we indebt our grandchildren. You are looking at Medicare, sovereign debt, pension funds, and on it goes, literally quadrillions of dollar value and they can’t even pay for that with the existing GDP. Current IOUs far exceed the ability to service that debt. Even with the highest stock market ever in the US, they still can’t pay for that. Governments need to find wealth from somewhere.

If a 10x return to $70,000 per BTC in the future clears part of the liabilities, why not let it run even further? If it pushes to $140K, people will then have money to spend and rekindle the economy.

Push it wide open to $210 /280K and it’s a party again:

- social in-fighting stops

- all of the wars stop

-

all of the home foreclosures stop

– huge reduction in homelessness begins

Once they get the match lit, it’s a rocket ship. Somewhere along the way, the central banks will begin liquidating their BTC holdings, but if you are reading this article — you’re in so early, you’re helping push the rocket to the launch pad. Ignition, now, is just months away.

Now, in my vision of the future, central banks have fixed their problems. They will want a bit of rotation or they will want a bit of stimulus in the economy — all they have to do is stimulate a new coin, rinse and repeat. Once people feel the wealth effect again — and I truly mean feeling wealthy — it’s going to be a new era. The feeling of the 1990s: spend today, as there is always more coming in tomorrow.

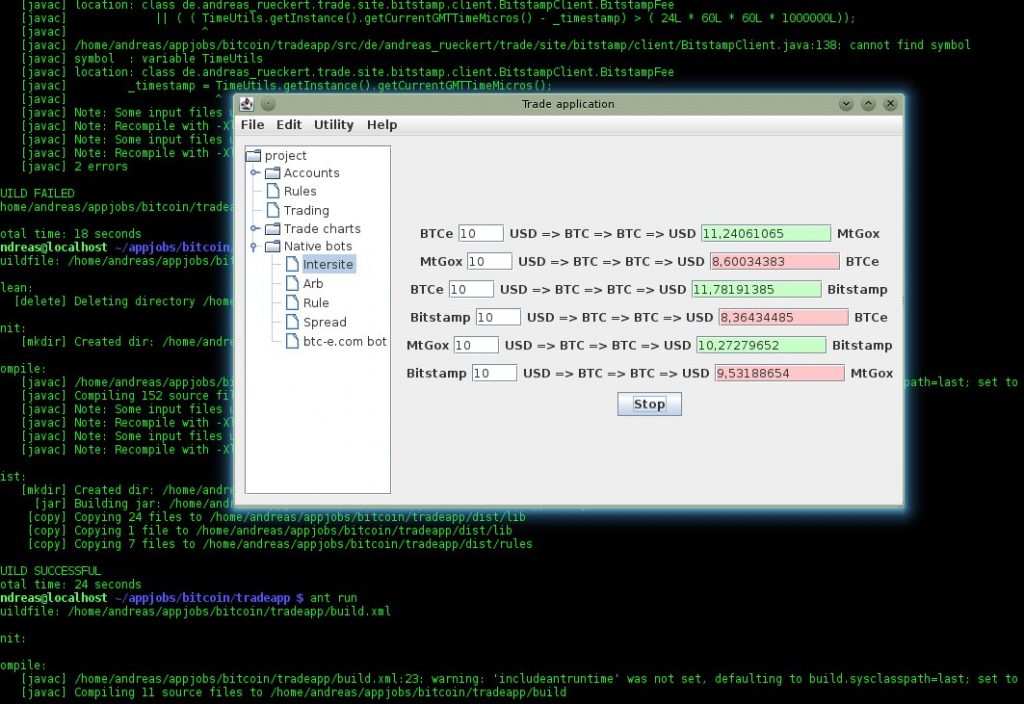

The BTC futures trading market, and how Ankorus is a direct avenue to CME BTC futures contracts.

1. “The roaring twenties” started with technological innovation: the radio and the car, especially. It’s the same thing here with how cryptocurrency’s starting off. It’s similar to how it was after world war one, when the world was in debt.

Imagine a meteorite just flew by earth, and it’s made of solid gold — just cruising by, in space — and we rocket up to it, harvest it, and bring it back into the Earth economy. This introduction of new wealth into the system would enrich everybody. Crypto is like that. It didn’t exist before, but now everyone wants a piece of it because it keeps going up. Its new wealth, magical new wealth, that has come out of nothing, and if everyone can get in on that… and they let it ride way up high, this will be new wealth that central banks and governments can use to repair all of the existing, broken, unfunded liabilities. Everybody can get in on it, and planners can fix the broken monetary system.

It doesn’t matter that it’s ones and zeros, it’s the belief in a new form of wealth that actually becomes a new form of wealth, the confidence of limited supply and value associated with a finite resource. Why is gold more valuable than aluminum? It’s the same with bItcoin, which has a limited supply, and when the world adopts it as a store of wealth, central banks need only have some of the underlier to start off the BTC futures, options and ETF markets — and send it to the moon.

Sovereign players will need to begin securing as much BTC as they can. They will be the big buyers of the actual BTC, storing it on a wallet, out of circulation in cold storage. Let’s term that “physical bitcoin” for lack of a better term. Once they secure enough of them, this is short squeeze that can carry on for a decade.

Think about this, instead of Fort Knox holding all of the US gold, now it protects just two flash drives containing 5 trillion in nominal BTC value. An army to protect flash drives in cold storage! Or facilities like Zapo in Switzerland, James Bond type high security vaults, all protecting cold storage crypto filled hard drives and wallets, holding the world’s BTC futures underlying cryptocurrency.

2. Universal Basic Income (UBI) — trigger words indeed. This divides along generational and socio-economic lines, but if central banks are not printing new money to implement UBI and jugive money to the people, crypto creates new wealth, without needing to debase fiat currencies further.

Socialist planners are not sacrificing something in a financial asset. They have tried before in real estate, they tried it in financial assets, but for UBI to work it will take a whole new asset that comes out of nothing, which has no impact on anything else, and can both be, and create, a source of wealth that won’t displace any other fiat or existing assets. BTC futures ticks all of the boxes on this and is a backdoor way to institute UBI that most can agree on.

Governments will be able to raise benefit allowances and social welfare spending, more people will have more money to buy real estate and afford rent, where before they couldn’t. This injection of wealth will begin to fix poverty everywhere.

3. Mitigate civil unrest as food prices climb higher due to the Grand Solar Minimum* losses in global agricultural output. Circa 2018–2019, I expect food prices will begin a seemingly inexorable upward climb, doubling and tripling along the way, which would normally lead to civil unrest. But, with the introduction of new wealth, the rally in food prices won’t matter because everyone will have money. It will be a “trickledown effect” for all.

4. Anyone, anywhere can invest in bitcoin futures, so new wealth should spread everywhere. Everyone can potentially connect to the internet via a phone connection, so practically everyone theoretically can gain access and participate. As BTC skyrockets, everything else will follow.

It will be like the stock market, big movers first then everything follows. People must feel the wealth effect before they begin spending again. BTC prices have risen enough to a point where people are beginning to believe, and there are success stories everywhere you look, from Mike Novogratz buying $100K of Ethereum at $1, to the guy who bought BTC for his Philippine village at $20; we haven’t seen this since the 1990s. A person who invested $10K three years ago is now worth $10 million. This is presently unheard of in the stock market.

All that hard work and saving money over a lifetime was worth nothing. As they print more and more money, and put more debt into the system, held wealth is diluted. This is nothing short of theft! For those seeing the spending power of their savings stripped away, pensions that cannot service existing systems, who cannot pay their bills and other obligations, the natural inescapable result is a festering animosity. The emergence or creation of a new source of wealth, to remedy the underlying fiat currency debt shortfalls, is essential.

As people begin to convert fiat to bitcoin and other cryptocurrencies, FX will sell off, and it will occur naturally. When hundreds of millions of people sell all of their currencies to buy crypto, there may even be a perceptible sucking sound, as all of that cash is vacuumed up by the cryptosphere. Currencies will likely then devalue equally, other than the USD (as the new BTC futures trading exchange will be located in Chicago, buyers will need dollars to enter the market, keeping the USD in demand).

Other BTC futures exchanges will follow, I assure you, but since the CME is first and has the head start, they will have the biggest exchange with the largest volume (it’s natural they will keep most of the volume due to ease of entry through Ankorus and traditional broker-dealers). To fill the contracts, this will need to be paid for in dollars, so there will be a pull of other fiat to convert to USD to get into BTC futures.

Since they are the first mover, the CME will be considered an authority on how to do it, how to structure it, how to guarantee it. Shortly after that, Ethereum futures, or perhaps Dash futures, are expected. Chicago will become the “go to” place, and everywhere else will have smaller markets. But the big players will go to Chicago, keeping the dollar strong to buy those futures.

A large number of other countries will start their own BTC futures, and here again lies the reputation of payment guarantee — you want a BTC futures contract, issued in Venezuela, or BTC futures contract issued in America?

5. There has to be a way to restart the consumer spending economy, without war or debt jubilee. If a debt jubilee happens, banks and creditors will never lend again from fear of non-repayment, and this will keep us in a feedback loop of a never recovering global economy.

6. “Algo” trading bots are so good now that volatility in the market has been eradicated and the bots have nothing to trade. It has now reached its apex in terms of even computerised trading.

7. The price point is 30-40% on margin for a contract according to the CME BTC futures spec sheet, so if people pool their money, they can afford a contract to control 10 bitcoin 3/6/9 months out. In addition there will be BTC ETFs and options.

If that’s the way the central banks are going, it explains just why they’ve been doing what they’ve been doing — they have to get all aboard first in order to run it up. They will then market it through popular television, sitcoms, business news …

Solving the world’s financial ills

Where BTC sits now, around $7000 — this is the base. It is an ingenious solution to solve all of the world’s financial ills at the same time. It all stemmed from hedge fund managers being continually asked to add crypto to their portfolios, but there was nothing on offer. The same big players were all getting the same requests from their customers. When there is massive pent up demand you can’t not do it.

This is where Ankorus among other crypto players is spearheading entry to BTC futures, and where everybody can sign up to trade them. From this point forward, it’s all about accommodating people into crypto and educating them along the way to preserve and expand their wealth.

If BTC futures can truly be used as an instrument of change, the possibilities for positive change across the planet are immense. Prevention of global war alone will, of course, be more than worth it.

*The author is an Ankorus adviser and also the producer of the Adapt 2030 YouTube channel, which argues that the planet is entering a mini ice-age due to a now dawning period of lessened solar activity, known as the Grand Solar Minimum.

Ankorus Main Links

Website: http://ankorus.org/

White Paper: https://www.ankorus.org/wp-content/uploads/2017/10/Ankorus-Whitepaper.pdf

Email: info@ankorus.org

Telegram: https://www.t.me/Ankorus

Facebook: https://www.facebook.com/Ankorus/

Twitter: https://twitter.com/AnkorusGlobal

Blog: https://medium.com/@Ankorus

YouTube: https://www.youtube.com/channel/UCXEUcDDwTGjtVF1xobqcdlQ