The big part of putting anything on the blockchain is who’s going to have the oversight of what goes on the blockchain? If something bad gets put on the blockchain — if something’s counterfeit — who’s going to insure that to makes sure that doesn’t happen? That’s the weak point with putting everything on the blockchain. An example: if you put a deed on there, who’s going to stand behind that deed and say that this deed is not counterfeit, this deed has title insurance. Without that, anyone could put anything on the blockchain. They could have five different deeds for that one property on the blockchain.

The big part of putting anything on the blockchain is who’s going to have the oversight of what goes on the blockchain? If something bad gets put on the blockchain — if something’s counterfeit — who’s going to insure that to makes sure that doesn’t happen? That’s the weak point with putting everything on the blockchain. An example: if you put a deed on there, who’s going to stand behind that deed and say that this deed is not counterfeit, this deed has title insurance. Without that, anyone could put anything on the blockchain. They could have five different deeds for that one property on the blockchain.

Who is Making Sure what Goes on the Blockchain isn’t Counterfeit or Fraudulent?

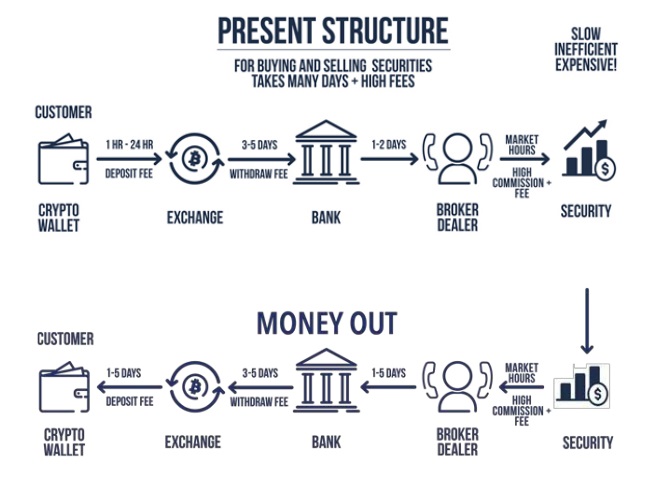

Moving from cryptocurrencies into financial assets is often slow and tedious — and always accompanied by multiple fees.

Now there’s an innovative solution to match the times, ANKORUS, a platform where cryptoholders can buy and sell any global exchange-traded financial asset.

This will include stocks, bonds, futures, sovereign debt, foreign exchange, commodities and more — all using cryptocurrencies.

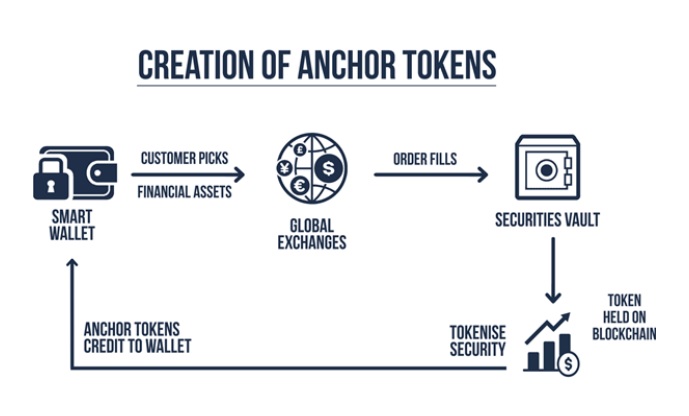

The added beauty with ANKORUS is that financial assets can also be tokenised, gaining all the advantages of blockchain technology while keeping the characteristics of the asset.

Once tokenised, assets can be traded for any other tokenised asset. And the holder is free to redeem anytime they want. As a registered broker-dealer, regulated by the FCA, ANKORUS will be unique in the space as all assets will be insured and auditable.

ANKORUS — raising standards higher for a better crypto world.

The following is a discussion with John Cruz, CEO of ANKORUS, about to launch its ICO on November 25th, and set to disrupt the financial industry.

In this exchange, I wanted to go deeper into how the company’s Anchor Tokens will be employed to purchase financial assets, and how this also is able to move seamlessly into the cryptocurrency space.

David DuByne: Let’s talk about where money started, how we progressed into stocks and futures markets, and where we’re headed to with tokenisation of financial assets in the future.

John Cruz: I’ll start about 150 years ago with the modern futures markets that started in Chicago. The reason that they started was because the farmers — the wheat farmers — had nowhere to hedge their exposure. So they started the Chicago Board of Trade, it was the first one to start. They would come in with their carts of wheat and they would be looked at and inspected. They would put them in warehouses, and in the warehouses they were insured, and once they knew that the wheat was good, they were able to trade those receipts in the future as futures contracts, and that’s how it started in Chicago.

It was put at the warehouse and inspected, almost like we’re trying to do today. We’re going to put it on the blockchain, but it needs to be inspected and made sure it is not counterfeit, [that] it’s up to standards. That’s what they need to really do in the modern world of blockchains.

D: So we talked about going back into the actual sales of wheat. You could walk up, you could put your hands on it, you could guarantee that it was the authentic item that you were purchasing. Today, when we put things on the blockchain, how do we guarantee they’re even authentic? I mean who’s overseeing this and what if something’s wrong? Who arbitrates in this? You were talking about [this] as we move forward with ANKORUS …

J: Exactly. The big part of putting anything on the blockchain is who’s going to have the oversight of what goes on the blockchain? If something bad gets put on the blockchain — if something’s counterfeit — who’s going to insure that to makes sure that doesn’t happen? That’s the weak point with putting everything on the blockchain. An example: if you put a deed on there, who’s going to stand behind that deed and say that this deed is not counterfeit, this deed has title insurance. Without that, anyone could put anything on the blockchain. They could have five different deeds for that one property on the blockchain

D: That goes right into the financial assets as well. One of the stopping points for the Securities & Exchange Commission (SEC) was all this cowboy Wild West finance raising. No insurance, no oversight, no arbitration. Nobody to back anything up. How is this ANKORUS ICO going to be different, with the SEC and broker-dealer [aspect]? Can you explain that a little bit.

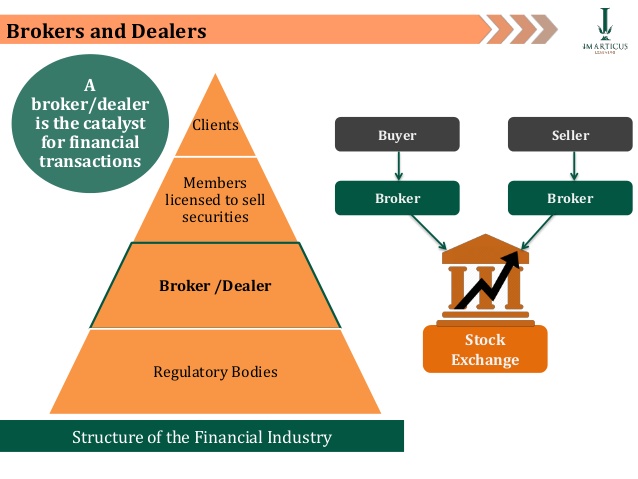

J: ANKORUS will become an SEC-related broker-dealer, which means that we will be covered by all the oversight and financial regulatory requirements of the SEC. So anyone can come to us and pay in crypto and buy any financial asset that they choose. The financial asset will stay with us, and as the custodian it’ll be insured. And then they can sell it at any time. They can redeem it at any time as Anchor Tokens. That’s why we’re using the present safeguards of an SEC-regulated broker-dealer to do this. Our competitors are not doing it, but we are.

D: So I know you mentioned stocks are one of the things that you can use Anchor Tokens to purchase and swap over. What other types of financial products are you going to be offering in this ICO? Stocks, everybody knows, but what about options maybe? I mean some people are familiar with that if you’re trading futures. What other types of things are we looking at?

J: Anything that a broker-dealer can fill you on. Everything from bonds, Treasury bills, Treasury bonds, stocks, options, futures. Anything that’s available at your current broker, we will be able to buy for you and tokenise.

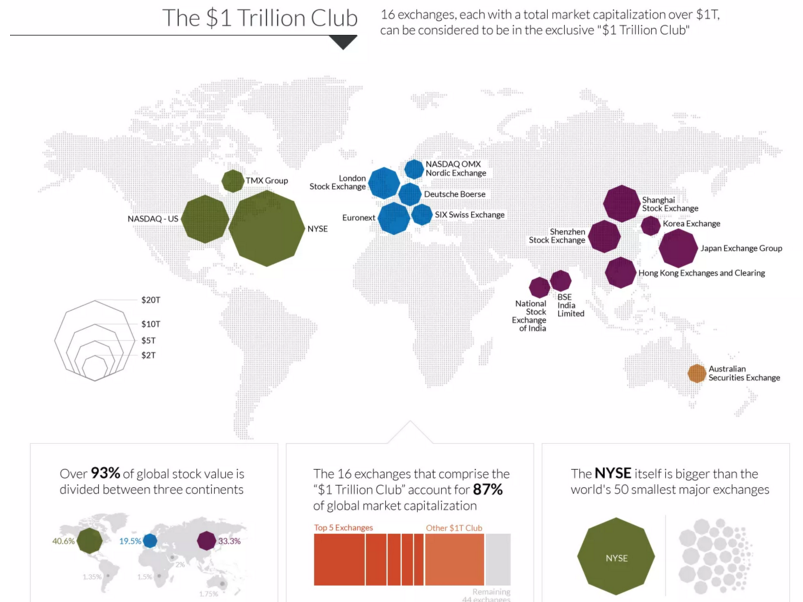

D: If I’m a US citizen can I get some exposure to a foreign market?Australia is pretty easy to buy. So let’s say I have a brokerage account, Ameritrade or something like this, online. I can buy into the Australian Stock Exchange, but what about some of these more exotic markets [which] some of these traditional exchanges that you’re going through online don’t have access to? Are you able to access those?

J: Eventually we will become a registered broker-dealer in those jurisdictions and will offer those products to our clients; which is what we want, to expand the total reach of it. We basically want to be a kind of Interactive Brokers and a Coinbase all rolled into one

D: So which markets are you going to start with after the ICO completes?

J: We’ll start with the American markets, the European markets, most of the major Asian markets. Then, after that, we’ll start getting into the secondary markets like Thailand, Indonesia, Malaysia, Philippines and Brazil.

D: John, also there’s been a lot of news recently — specifically this week — about bitcoin options coming out. That’s taking everybody by storm. They don’t even know where this has come from, how these people are able to do it, since all the way up until this last week, everybody’s been forbidden from trading any financial assets, due to SEC regulation. So what just happened that flipped the coin, literally, no pun intended, to allow these financial assets to be traded through the blockchain now?

J: Ledger X came out with bitcoin options and the Chicago Board of Options Exchange (CBOE) will also be offering bitcoin options, and you’ll be able to access both of those through us, because we will also become a member of the Chicago Board Options Exchange. Cryptocurrency traders right now, if they have an account through Ankorus, through our broker-dealer, they’ll be able to hedge their exposure to bitcoin prices using those options at the CBOE.

D: So I’ve heard you mention broker-dealer a couple of times. What type of special rights does being a broker dealer give you in this whole economic sphere and dealing with stocks, dealing with traditional markets, financial regulation by the SEC? Can you go into that in greater detail as well?

D: So I’ve heard you mention broker-dealer a couple of times. What type of special rights does being a broker dealer give you in this whole economic sphere and dealing with stocks, dealing with traditional markets, financial regulation by the SEC? Can you go into that in greater detail as well?

J: One of the main benefits for our customers by being a broker-dealer and a member of the exchange is that we’re able to give the lowest possible commissions. So in that way we’ll be very close to a Robin Hood app, where they have no commissions. We’ll be comparable to them. The other thing that we offer customers by coming through us is they have insurance and oversight to make sure everything they buy is accounted for and they’ll get a daily statement, and getting your statement daily is a big thing. You don’t have to worry about risk of default, like cryptocurrency exchanges, you don’t have to worry about your account being hacked. Everything is safe with us. They’re the safeguards that everyone’s used to; right now we’re just bringing them into the crypto space and the crypto guys can come to us and preserve and anchor some of their wealth, that they’ve made in these crypto markets, to financial assets.

D: So, if I got this right, the Securities Investor Protection Corporation (SIPC), is that the insurance [regarding] these financial assets you’re talking about trading, are they covered under there? That’s going to be a big thing for everybody moving forward?

J: Yes, as a registered broker-dealer we’ll cover it on the SIPC, absolutely, and we will be audited on a regular basis by the exchanges and [also] audited by the regulatory authorities.

D: One point you touched on, you were talking about getting the lowest possible commissions for your customers and users of Anchor Tokens. Are you going to get an exchange seat or are you working with somebody in the wholesale market / secondary market? How are you able to get these commissions that are going to be low or almost no fee?

J: We’ll have an exchange seat at the Chicago Stock Exchange. We’ll also get a seat at the Chicago Board of Options Exchange. So our equity prices will be as low as possible. We’ll just pass that on to our customers and our options prices will be lowest that we can possibly get and that’ll also be passed on to our customers: our cryptocurrency customers and our traditional broker-dealer customers.

D: Now that you’ve brought me up to speed on that, I’m interested in purchasing some of these Anchor Tokens. And now that I have a handful, let’s say I have $500 worth, and I want to buy half a share of Amazon stock, which is currently around $1,000, and I know one of the things you were focused on is fractionalising US equities or portions of some type of security. Walk me through the process. Okay, I have my Anchor Tokens; I want to get half of a share of Amazon stock. Now what do I do from this point forward, how do you know I even want Amazon?

J: Well, the customer comes to us and then decides what stocks or financial asset they want and we accommodate them. They go straight to the exchange and they make their purchase. Then they can keep it in their account or they can have it tokenised, whatever they would like. So if they have it tokenised, it becomes an Anchor Token, and it goes in through a smart wallet, or they can just leave it in their account and they get a daily paper statement. And then once they have their Anchor Tokens, they can hold them, store them, trade them in the secondary market. They could redeem them whenever they like.

D: So, correct me if I’m wrong, this would also give me a different way to hold out in extreme market volatility, because right now the only way I have to do it is by USD Tether. So if I could slide sideways, using Anchor Tokens, into something incredibly stable in the stock market, that would allow me to ride out the storm and then come back in of my same purchasing power again without using Tether. Is that right?

J: Exactly, but you can also buy dollars through us and create your own dollar Tethers. That’s also a possibility. We can also fill you on currencies; whatever currency you like. So you’re not only locked into the dollar but any currency that we can fill you on. You can tokenize that and you can make your own Tether.

D: That sounds really interesting, because I know a lot of the cryptocurrency traders, they’re locked into the ecosystem. I mean, you have very few choices except to slide between some of the underlying assets there. You can use bitcoin as your underlier. You can use USDT. Now, you can use Ethereum. But everybody’s still swirling around in this same cryptosphere, if you will. There’s nowhere to really run outside that. So this sounds like another option for people to exit; and some of these cryptocurrency investors [can] bring different and new institutional money in in a different form.

J: Exactly, Dave. The other thing that we’re going to do is accommodate the non-traditional cryptocurrency traders that want to come into the market. Right now it’s very hard and cumbersome for them to get on board at the crypto exchanges, even to get onboarded at Coinbase. By going through us, the process is streamlined, because they come to a broker-dealer and then they’re able to purchase their cryptocurrencies on any one of these crypto exchanges using the ANKORUS platform.

D: This sounds incredibly controversial because I know from talking to a lot of people in blockchain, they’re purists out there and they want the decentralisation aspect of this cryptocurrency ecosystem untainted. You’re bringing traditional finance right back into it, which is a sticking point for them because they want to go into full decentralisation, where you’re trying to swing the pendulum back into institutional money. So what kinds of advantages are there to bring institutional finance into the crypto sphere?

J: We believe that decentralisation is great in theory, but no one has really been able to solve that problem, and its a few years off. So, we, ANKORUS, will be a transition to that as we bring in enough money to make all these cryptocurrencies go up. Because with the institutional money you have the air coming into the balloon to help to inflate all of these prices. Right now, I think the prices of all the cryptocurrencies are tremendously undervalued and with the financial institutions coming in that’ll only make for a long-term appreciation for all cryptocurrencies. People would like to think it’s a bubble. But we don’t think it’s bubble. We think it’s here to stay and it’s the future of financial markets — cryptocurrency.

D: Right, and if I could add something as well here with that. From my numbers that I have, 0.03 per cent of people on this planet have access to, or actually own, cryptocurrency at this point. When we move into 2018–2019, these numbers are forecast to get up to about 3–4% global usage and acceptance. You realize that’s hundreds and hundreds of times over what is currently 0.03 per cent of the population now. So when we’re talking about cryptocurrency eating in on itself, I mean when the price of bitcoin is in a bull market, it screams up and then everything else across the board falls. What do you see with this, moving over and moving ahead, if institutional money comes in?

J: Well, by having ANKORUS have financial assets and crypto all under one entity, we don’t need the banks, because we’ll easily move money from the financial side to the crypto side and back again to financial assets. What we’re really doing here is cutting out the traditional banks. And, that way, everything is accessible under one roof with us.

D: That sounds like what a lot of people really want to hear is cutting out the traditional banks because [of] the margins they are pulling and the fees. We’ve all experienced high fees and banks, and nobody likes it. I don’t even know one person I’ve ever met that says I really like those high fees the banks charge me every time a buyer sells something!

J: Exactly, and we also cut down the time. Think about the time it takes to move your money from the bank to your brokerage account, from your brokerage account back to the bank, back to the crypto exchange. That’s just a waste of time — and time is money. So, by having everything under one entity, the broker-dealer entity, which is basically a synthetic bank, we cut out the bank and we cut out all that waiting time.

D: So when you talk about speed of transactions, how fast are you talking, about minutes, hours, days?

J: I’ll walk you through it. Basically, someone comes in — as an example — and sells their Apple shares. They get their cash and they immediately go and buy their cryptocurrencies, whichever one they’d like. Let’s say they see something move in another stock or another bond; they sell their cryptocurrencies, they get cash in their account, then they buy that. They can move back and forth seamlessly without having to go through the banking system.

D: That sounds like decentralisation 2.0 to me, repacked for the real world, with a lot more liquidity, in a much, much larger market, which would allow cryptocurrency to actually expand. I think the mind-frame right now, with the decentralisation, the way it’s moving, it is constricting or bottlenecking some of what could be gains or expansion inside the crypto world.

J: Decentralisation is good, but it will take a while as there’s really no technology out there and it has to get acceptance by the regulatory authorities and the governmental agencies. So what we’re doing is we’re trying to build decentralisation with the current system, as it works. Decentralisation really means cutting out the banks, because the banks are the bottleneck of bringing money from crypto back into financial and financial back into crypto, and the banks have to be done away with.

D: Tell me more about how people can contact you once the Ankorus ICO is running. Do you have some contact links and social media so they can connect with you?

D: Tell me more about how people can contact you once the Ankorus ICO is running. Do you have some contact links and social media so they can connect with you?

J: You can follow us at ANKORUS.org and we’re on Twitter, Facebook, Telegram. The ICO is going to start on November 25th and it’ll end on December 26. Our hard cap is $45 million and we’re looking to raise that and be oversubscribed. So, in the secondary market, when we list our ANK tokens, they will continue to go up.

Ankorus Main Links

Website: http://ankorus.org/

Whitepaper: https://www.ankorus.org/wp-content/uploads/2017/10/Ankorus-Whitepaper.pdf

Email: info@ankorus.org

Telegram: https://www.t.me/Ankorus

Facebook: https://www.facebook.com/Ankorus/

Twitter: https://twitter.com/AnkorusGlobal

Blog: https://medium.com/@Ankorus

YouTube:https://www.youtube.com/channel/UCXEUcDDwTGjtVF1xobqcdlQ

ICO Whitelist https://docs.google.com/forms/d/e/1FAIpQLSc04cYrCl_Pfp-OFzHFUeKsb6x-EIO4eFBpWW5KT9YanFV3Cg/viewform