I had a chance to ask John Cruz CEO of Ankorus questions that arise when you mention asset tokenization in a cryptocurrency ICO. My first thoughts are SEC and financial regulators, how will you get around that and protect investor funds? Here is what he had to say. By becoming a broker-dealer entity, we will get the SEC's blessing. Everyone else is trying to tokenize assets while not being a broker-dealer entity, this is where they run into trouble with the SEC.

I had a chance to ask John Cruz CEO of Ankorus questions that arise when you mention asset tokenization in a cryptocurrency ICO. My first thoughts are SEC and financial regulators, how will you get around that and protect investor funds? Here is what he had to say. By becoming a broker-dealer entity, we will get the SEC's blessing. Everyone else is trying to tokenize assets while not being a broker-dealer entity, this is where they run into trouble with the SEC.

How the Ankorus TGE Will Pass a SEC Sniff Test While Tokenizing Financial Assets

I had a chance to ask John Cruz CEO of Ankorus questions that arise when you mention asset tokenization in a cryptocurrency Token Generating Event (TGE). My first thoughts are SEC and financial regulators, how will you get around that and protect investor funds? Here is what he had to say.

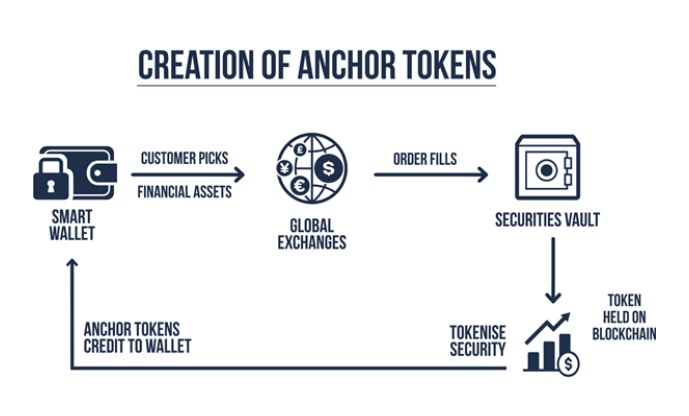

From the Ankorus Executive Summary: The Anchor Token system will be an alternative investment ecosystem that tokenizes and makes available any financial instrument, including stocks, bonds, futures, options, gold, silver, commodities, REITs, ETFs and sovereign debt. This will allow cryptoholders to truly diversify their portfolios across multiple asset classes and buy real world financial assets in exchange for cryptocurrency.

David DuByne: John, I will just say SEC, how are you going to overcome this issue?

John Cruz: By becoming a broker-dealer entity, we will get the SEC's blessing. Everyone else is trying to tokenize assets while not being a broker-dealer entity, this is where they run into trouble with the SEC.

David DuByne: By being a broker-dealer what type of special rights does this give you, others have been trying this concept, but how do you think you can overcome the scrutiny and the sniff test of the SEC?

John Cruz: As a broker-dealer, broker-dealers can structure securities & financial products and as long as they get SEC approval, they are able to sell those products. Right now every one else is trying to structure products using technology, but they are not going through the SEC’s vehicles that have been built for that. Using precedent from other SEC products that were approved, we are sure we can get approval as well.

David DuByne: If I am going to invest in Ankorus, what about auditing and safeguards, you talk about being a broker-dealer, tell me about the safeguards for my investment.

John Cruz: One of the first safeguards is (Securities Investor Protection Corporation) SIPC Insurance, where your cash is covered up to $900,000 and your securities are covered. The other oversight that we have is that we will be audited on a continual basis from SEC and the membership on our exchange seat at the London Stock Exchange. Outside auditors are invited to audit us also. We are regularly audited, that is one of the main safeguards of Ankorus.

David DuByne: Talk about the exchange seat.

John Cruz: We are going to purchase a seat on the London Stock Exchange so we get the lowest commissions possible for our customers and we are aiming for commission free trading for all equity products.

David DuByne: Walk me through the process after I buy Anchor Tokens, how do I purchase an asset? Where is my money John?

John Cruz: Your physical asset is in your segregated account at the broker-dealer, and you have custody of your Anchor Tokens. You get a daily statement form the broker-dealer so you see that your assets are there. Your Anchor Tokens are proof of ownership and you can also have an accredited beneficiary, so if anything happens to you, family members can come and claim your Anchor Tokens against your assets at the broker-dealer.

David DuByne: So I first need to purchase Anchor Tokens and then I can purchase US equities or financial assets?

John Cruz: First you come to us and choose the asset that you want, you pay for the asset that you want, then we credit it to your smart wallet. With that Anchor Token, you can hold it, you can redeem it, you can trade it, or you can transfer it. They are very similar to TETHER (USDT) except you have a segregated account which you can access at anytime, held at a licensed regulated broker-dealer.

David DuByne: Potential for usage?

John Cruz: Cryptocurrency traders are presently locked into the existing cryptocurrency ecosystem that that they cannot leave. They can only keep funds in crypto or USDT Tethers, but now Anchor Tokens allow them the opportunity to move some of their wealth into financial assets seamlessly.

Ankorus is a cross between Coinbase, E-Trade and Tether, all rolled into one.

Ankorus TGE runs from November 25th to December 25th and there is no Pre-Sale to make open and transparent for everyone.

Download the whitepaper www.ankorus.org

David DuByne is the creator of ADAPT 2030 Video Series that discusses the intensifying Grand Solar Minimum, a 400 year cycle in the Sun which will effect global crop yields and the move to smart contracts for payment guarantee for grain deliveries by 2020.