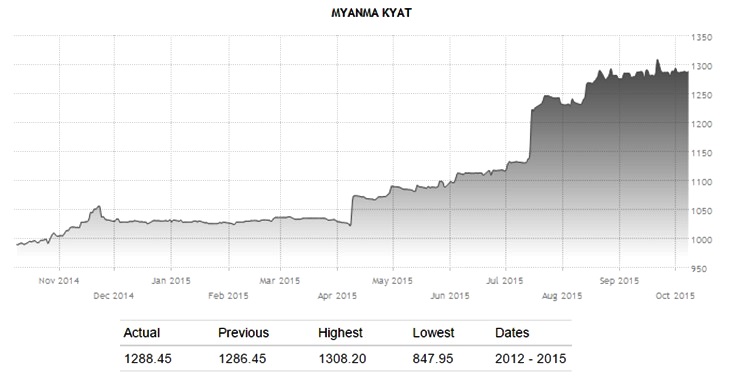

Between June 2012 and October 2015, the Myanmar Kyat depreciated by approximately 35%, from 850 down to 1300 against the US Dollar.

Between June 2012 and October 2015, the Myanmar Kyat depreciated by approximately 35%, from 850 down to 1300 against the US Dollar.

Local businesses with foreign denominated loans from abroad suddenly found themselves rushing for a strategy to mitigate currency risks. Myanmar’s current lack of available currency hedging solutions presents a real challenge for these firms.

How Myanmar can Hedge Foreign Loans for Geothermal Projects to Mitigate Kyat Devaluation Risks PDF

How Myanmar can Hedge Foreign Loans for Geothermal Projects to Mitigate Kyat Devaluation Risks

By David DuByne

Financing Geothermal projects showing surface temperatures near or greater than 50°C have potential for Binary Cycle Power Plant Generation with an estimated break even power cost of 5.3-8.6 U.S cents/kWh or in Myanmar Kyat 53-86K per kWh. This pegs a non-fluctuating 1$=1000K, which is a main concern for power project funding.

Between June 2012 and October 2015, the Myanmar Kyat depreciated by approximately 35%, from 850 down to 1300 against the US Dollar. Local businesses with foreign denominated loans from abroad suddenly found themselves rushing for a strategy to mitigate currency risks. Myanmar’s current lack of available currency hedging solutions presents a real challenge for these firms.

With the IMF forecasting Myanmar’s economic growth at 8.25% in 2016, demand for credit is increasing, yet, the bulk of SME’s remained credit deprived. Myanmar’s forward thinking Union Government wanting to continue economic development to address this problem, issued a new draft of the Public Debt Management Law, which not yet in force, is aimed at restating and clarifying some of the existing rules with respect to Government loans, bonds, borrowing & guarantees.

States and regions may obtain foreign financing, but with Union Government and National Assembly’s approval. In the same law, foreign banks will be able to issue loans to State Owned Enterprises (SOE’s) and there are nine clauses describing when the Union Government can obtain foreign financing.

The main drawback with these proposed changes is that along with depreciation pressures, in the current FX derivatives market there are no currency forwards for long term foreign denominated loans on the Kyat.

Meaning, currency volatility is clearly a risk. Hedging solutions backed by a basket of currencies to mitigate risk and offset losses not effectively covered by commercial markets, should be included in Myanmar’s central risk mitigation strategy by diversifying exposure over a number of currencies worldwide.

In USD terms, un-hedged loans using a basket of emerging market currencies and major trading partner’s currencies will minimize the impact of an un-hedged position when spread through USD, THB, & SGD for example. This will allow the borrower at disbursement to receive funding denominated in local currency and is a local currency loan liability. All cash flow movements are actually still done in USD offshore.

This will minimize currency risk from Myanmar borrowers and reduce non-performing loans to under 1% for foreign firms able to fund and finance machinery and services. This must be a core part of any discussion involving machinery loans for infrastructure build outs countrywide, especially on longer term projects such as geothermal energy, ports and water treatment.

Binary Cycle Geothermal Power Plants cost approximately $30 Million to install for 50MW of power output. A 25% devaluation would result in the original $30 million costing $37.5 million if the loan is not floated with an international basket of currencies. No government official will take that risk as the direction and ultimate value of the Myanmar Kyat is still uncertain.

David DuByne is the Myanmar contact for U.S. Exim Advisors. We represent a Direct Lender for the U.S. EX-IM Bank with Private Market for Medium Term Loans and Trade Credit Insurance. David can be reached at ddubyne (at) useximadvisors.com